We are delighted to announce the acquisition of portfolio company Flusso for £28m, resulting in an excellent return for our EIS investors. The flow sensors technology specialists company Flusso has been jointly acquired by an international company, and a global private equity fund, to expand its product portfolio into flow and environmental sensing. The exit brings the total cash returned to investors by Parkwalk to over £100m.

18th August 2022

Flow sensing company, Flusso Limited has been jointly acquired for £28 million by an international company and a global private equity fund focused on investing in semiconductor companies and other high-tech industries.

The transaction will enable the acquirers to expand their current product portfolio into flow and environmental sensing, and to establish a European footprint in Cambridge, UK to add to their existing facilities in the US and China. It will also give Flusso immediate access to significant additional expertise and capacity in the design, development and manufacture of new semiconductor devices.

Flusso will continue to operate under its own brand name and with its existing management team under the direction of CEO and company co-founder Dr Andrea De Luca.

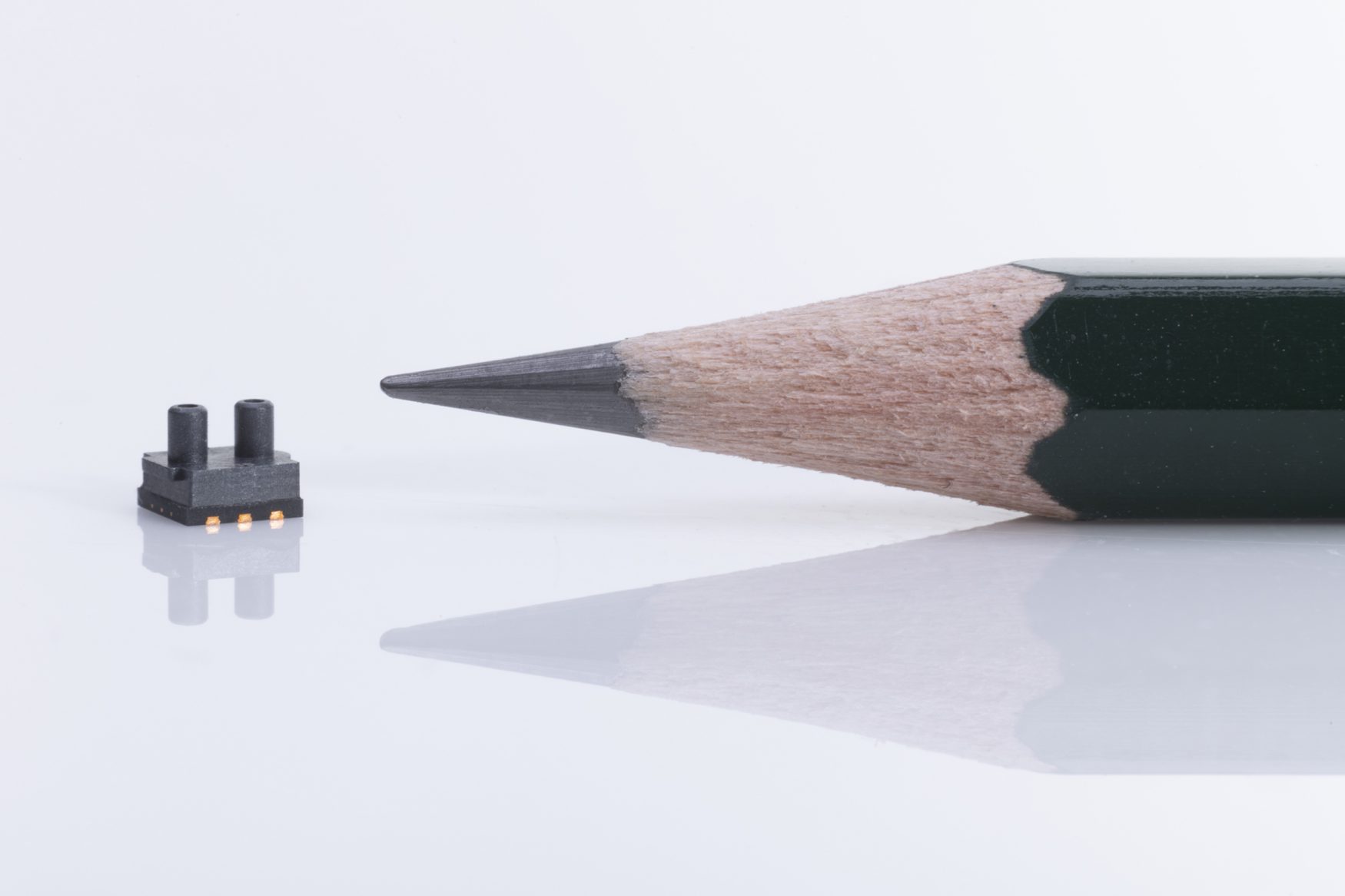

Flusso was founded in 2016 as a spin-out from University of Cambridge with support from Cambridge Enterprise, the university’s commercialisation arm. The company completed a significantly over-subscribed series A round in June 2020, led by Parkwalk Advisors, to raise US $5.7 million (£4.65 million), and launched its first product, the FLS110, as the world’s smallest flow sensor targeting high-volume consumer, industry and medical applications later that year.

Commenting on the acquisition, Dr Andrea De Luca, CEO of Flusso said: “Everyone at Flusso is excited by what this acquisition means for our business as we power into a new phase of development. It will help to accelerate the commercialisation of our flow sensing product lines; to fast-track the development and launch of our gas sensor products for environmental applications; and allow us to increase the investments and engineering resources allocated to developing new sensor innovations. We will also get improved access to markets and customers, particularly in Asia.”

John Pearson, Investment Director at Parkwalk, said: “Parkwalk is delighted about the acquisition of Flusso, which will provide the business with the growth funding it requires for the next stage. We have supported Flusso since early 2019 and always felt that the mixture of truly innovative technology and a highly experienced team would ensure the success of this company.”

For more information on Flusso, see their website here or our portfolio page here.

Flusso was originally an investment in our early stage University of Cambridge Enterprise Funds (UCEF) run in conjunction with Cambridge Enterprise. The company then received subsequent funding from our Opportunities EIS Fund, so is a great example of our university deal flow network.

Read more on our UCEF EIS funds here.