University spinouts represent one of the most exciting and unique investment opportunities in the modern innovation landscape. These companies emerge directly from academic research, bridging the critical gap between groundbreaking scientific discoveries and commercial applications that can transform entire industries.

The Unique Value Proposition

At their core, university spinouts are technology companies born from rigorous academic research. They emerge from the scientific, engineering, and medical departments of world-leading universities, bringing with them a level of intellectual credibility that sets them apart from traditional startups.

Unlike conventional early-stage companies, spinouts are founded on years of validated research, often representing significant technological breakthroughs that have already undergone extensive scientific scrutiny. This provides investors with a more robust foundation for potential success, reducing the typical risks associated with early-stage investments.

Intellectual Property Advantage

The most compelling aspect of university spinouts is their robust intellectual property (IP) portfolio. These companies typically arrive in the market with patented technologies and proprietary research that represent years, sometimes decades, of focused academic investigation. Prestigious institutions like Oxford, Cambridge, and Imperial College have sophisticated technology transfer offices. These ensure only the most promising research becomes a commercial venture.

This means investors are accessing technologies that have already passed multiple layers of scientific validation, with a clear path from academic research to potential market application.

Diverse and Innovative Sectors

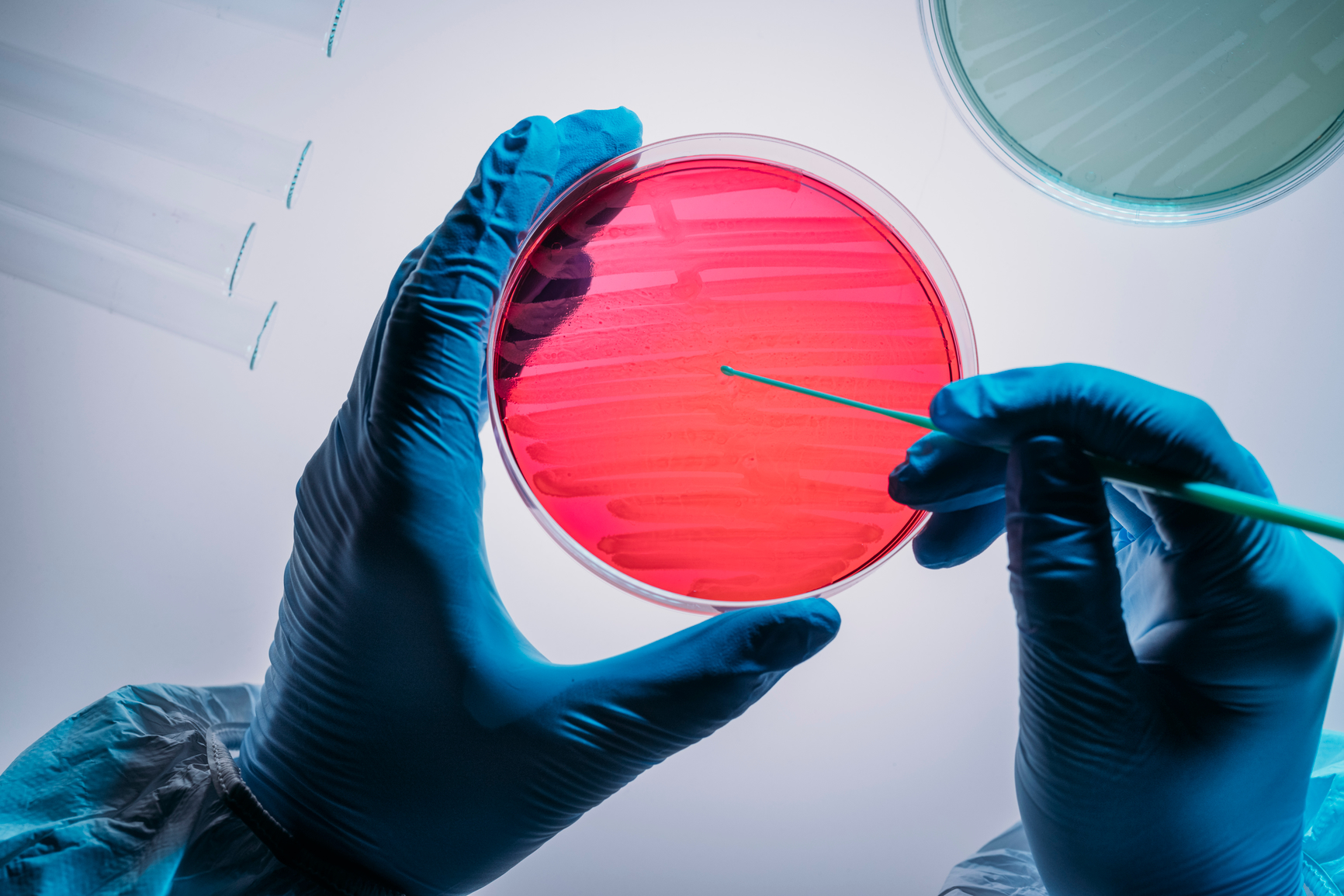

University spinouts span an incredibly diverse range of sectors, offering investors exposure to cutting-edge innovations. From revolutionary medical treatments and advanced healthcare technologies to artificial intelligence, clean energy solutions, quantum computing, and advanced materials, these companies represent the absolute forefront of technological innovation.

Life sciences spinouts might be developing groundbreaking treatments for previously incurable diseases. Technology spinouts could be creating AI algorithms that transform entire industries. Clean energy spinouts are addressing critical global challenges like climate change, while advanced materials companies are developing technologies that could revolutionize manufacturing and engineering.

Investment Support and Risk Mitigation

The Enterprise Investment Scheme (EIS) makes investing in university spinouts even more attractive. EIS provides significant tax advantages, including income tax relief, capital gains tax deferral and disposal relief, and loss relief. This additional layer of financial protection makes spinouts an increasingly compelling investment option for sophisticated investors.

These companies frequently qualify for Knowledge Intensive status, which can provide additional benefits to investors.

Moreover, these companies often benefit from continued academic support, access to cutting-edge research facilities, and connections with leading researchers. This ongoing support provides an additional layer of credibility and potential for success.

The Human Capital Advantage

University spinouts come with an exceptional human capital advantage. The founding teams typically include world-leading researchers with decades of specialized knowledge and a deep understanding of their technological domain. These teams combine academic excellence with an increasing focus on commercial application, creating a powerful combination of scientific rigor and entrepreneurial drive.

Supporting Innovation Ecosystem

Investing in university spinouts is about more than financial returns. It’s about supporting an innovation ecosystem that drives technological progress, creates high-value jobs, and addresses critical global challenges. These investments help translate academic research into real-world solutions, supporting economic growth and technological advancement.

Conclusion

University spinouts represent a unique investment opportunity at the intersection of academic excellence and commercial innovation. By investing in these companies, investors gain access to groundbreaking technologies, support critical research translation, and participate in solving some of the world’s most complex challenges.

Parkwalk Advisors Limited (Parkwalk) is authorised and regulated by the Financial Conduct Authority: FRN 502237. Investments referred to in this news article are not suitable for all investors. Capital is at risk and investors may not get back the full amount invested. Any investment in a Parkwalk product must only be made on the basis of the terms of the full Information Memorandum. Tax treatment depends on the individual circumstances of each investor. Parkwalk is not able to provide advice as to the suitability of investing in any product. Past performance is not a reliable indicator of future results.This financial promotion was approved in January 2025.