We’re pleased to share that Parkwalk has participated in a £2.0m funding round for Semarion, a spin-out from the University of Cambridge’s Cavendish Laboratory. Semarion is commercialising its SemaCyte® platform, which transforms in-vitro cell handling for applications in drug discovery and life sciences R&D. The funding will support team expansion, further product development, and building a pipeline of commercial sales.

Background

Semarion is a University of Cambridge spin-out, founded in 2018 by Dr. Jeroen Verheyen, Dr. Tarun Vemulkar, and Professor Russell Cowburn FRS. The company is revolutionising how scientists work with adherent cells—vital for drug discovery and life science research—by enabling greater flexibility, scalability, and data richness in cell-based assays.

Traditional methods for handling adherent cells are slow, costly, and inflexible. These constraints limit assay miniaturisation, slow down development timelines, and hinder the use of scarce cell types like iPSCs and primary patient cells. Semarion’s proprietary technology directly addresses these bottlenecks.

Since its inception, Semarion has raised £2.4M in equity funding to develop and validate its core platform. With this new £2.0M pre-Series A round, the company will have secured a total of £4.4M in funding to date. This capital has enabled the team to build a robust R&D foundation and establish early traction with several R&D early adopters, including top-tier pharmaceutical and biotech companies who are actively piloting the technology in their internal workflows.

These early partnerships validate both the need for and the impact of the SemaCyte® platform, and position Semarion for a successful transition to commercialisation in the coming 12–24 months.

The Technology

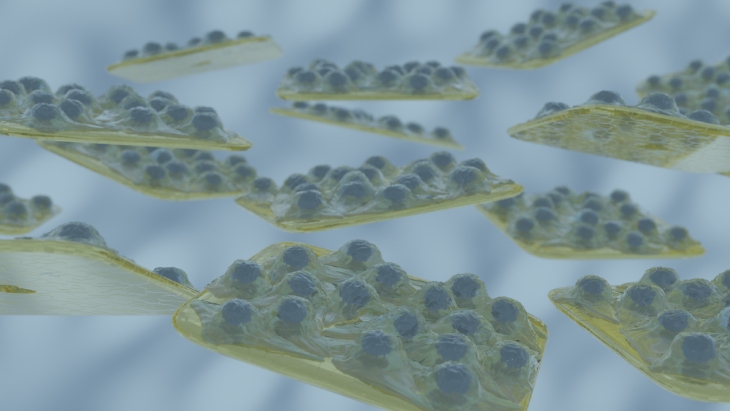

Semarion’s SemaCyte® platform transforms adherent cells into liquid reagents using patented microcarrier technology. These flat, barcoded carriers support adherent cell growth and are then suspended in liquid, enabling faster, scalable, and miniaturised assays without disrupting cell morphology. Key benefits include:

- Increased throughput via cell multiplexing, reducing workflow times by up to 10-fold and costs by 6-fold.

- Enhanced flexibility via adherent cell freezing, reducing preparation times for assays by up to 20-fold.

- Improved resource use via assay miniaturisation, reducing scarce cell use by up to 100-fold.

The technology improves assay speed, data quality, and the breadth of data gained from scarce cell types like iPSCs and primary patient cells.

The Intellectual Property

Semarion’s technology is protected by three core patent families covering its unique magnetic properties, innovative cell capture and release system, and specialized cell-repellent carrier walls. Beyond these patents, the company has developed deep expertise in manufacturing and applying their platform, ensuring strong intellectual property protection and competitive advantage.

The Market Opportunity & Business Model

Semarion addresses a rapidly growing market for advanced cell-based assay solutions, driven by increasing demand in drug discovery, research, and regulatory shifts reducing animal testing. The global cell-based assays market, valued at nearly $19Bn in 2021, is expanding alongside high-throughput and high-content screening sectors—estimated at $26Bn and $1.5Bn respectively—with strong growth projections. Semarion’s innovative platform enhances data quality and speed, supports complex cell systems, and offers unique multiplexing capabilities, positioning it well to meet the evolving needs of pharmaceutical, biotech, and research customers.

The Team

Jeroen Verheyen, Founder & CEO. Jeroen has been leading the development of life sciences applications for the SemaCyte® platform since 2017. His previous research activities included diagnostic renal cell carcinoma screening (Dept Surgery/Physics, CRUK) and the development of RNA and cell therapeutics for spinal cord injury (Dept of Clinical Neurosciences), both at the University of Cambridge. He held a position as Biopharma Principal at Cambridge Innovation Consulting and co-founded a water purification social enterprise, Majicom.

Tarun Vemulkar, Founder & CTO. Tarun has been leading the material design and fabrication of the SemaCyte® platform since 2017. At the University of Cambridge (Dept of Physics) he developed novel solid state nanomagnetic materials for biomedical applications such as renal cell carcinoma screening and glioblastoma treatment. As a Process Engineer at Micron Technology, he optimized industrial-scale microprocessor manufacturing.

Russell Cowburn, NED. Russell is Professor of Experimental Physics (Cambridge University) and supported the development of the SemaCyte® platform. His research career has focused on nanomagnetism, nanotechnology, and optics. He is a Fellow of the Royal Society and the Founder of Durham Magneto Optics.

Paul Wallace, Chair. Paul is currently the Chief Business Officer at Mission Therapeutics and has over 20 years of international business development experience across several drug discovery companies. Most recently, he was EVP and Head of Business Development for Medivir AB. His out-licensing partnerships have been at a total value of $4.5B, and he was a member of executive teams that have raised >$200M and completed 5 trade sales/acquisitions.

Del Tresize, NED. Del has over 20 years’ experience in biotech and large pharma. After a 5-year period as the Director of the Biological Reagents and Assay Development group at GSK, Del co-founded Essen Bioscience. Under Del’s leadership, Essen BioScience became, and remains, a world leader in instruments, software, reagents and consumables for real-time live-cell imaging and data analysis. Essen’s strong market presence led to a $320M acquisition by Sartorius in 2017. Del currently also holds board seats at the stem-cell manufacturer Axol, The European Laboratory Research & Innovation Group, and a strategy development role at Sartorius.

The Investment Case

Semarion recently secured a £2M pre-Series A round led by Parkwalk with support from Cambridge Enterprise. This funding will enable the company to convert pilot projects into paying customers, generate early revenues, and build a commercial sales pipeline through key hires. These steps lay the groundwork for a Series A round in late 2026 aimed at scaling operations and achieving EBITDA breakeven.

To find out more about Semarion, visit their website or our portfolio page here.