Luck/Skill – It is tempting to think that success in investing, and in life, is never accidental. No accidents or randomness, just planning, strategy, hard work, logic.

If there is no luck then success is seen in an even greater light. Denying the existence of luck appeals to the human urge to control everything, hence the popular statement ‘you make your own luck’.

I believe however, that a great number of things contribute to success, some of which are our own doing while many others are out of our control.

There is no doubt that hard work and planning are essential for success but even the hardest workers and best decision makers will fail to succeed consistently without a degree of luck. These components range from birth and genetics, to chance meetings, fortuitous choices and unforseeable events.

We arrange our lives, or in investing – portfolio’s, in expectation of what we think will happen in the future. In general, we get the desired results if future events conform to our expectations, and less desired if they don’t.

That sounds fairly fact-based and luck-free, but that is only the case on the average and in the longest-term sense.

Sometimes, even though an investor’s projections may be fundamentally far too optimistic (‘wrong’), the investor is bailed out by unforseeable positive circumstances. Either way the stock rises and the investor is applauded. I would say he was ‘right for the wrong reason’ (or ‘lucky’).

Likewise a prudent investor may form a reasonable view of the future, only to see the world go off the rails and his investments fail. He could be ‘wrong for the wrong reason’ , (or ‘unlucky’).

Timing also plays a large part, which can also often be down to luck. An investor may have taken an appropriately cautious stance, say in 2005 in mortgage backed securities, only to see an irrationally overpriced maket continue for another 3 years. He looks terrible, his investors pull out and he loses his money. He is right, but too far ahead of time. Unlucky, rather than a lack of skill?

In 1976 an analyst called Joe Granville, warned off the market and this was followed by a 26% 2 year decline, winning him respect and fame.

But, his next accurate call did not come for 24 years. So, he was right for 2 years, and wrong for 24. Was it skill back in 1976, or a lucky call?

Either way, he became famous for being ‘right once in a row’.

The thing is, in investing it is damm hard to know what will happen, but near impossible to know when. This is where being successful requires a significant degree of luck. It plays a huge part in outcomes.

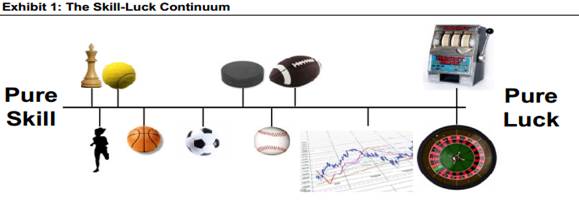

Luck plays a larger part in some things in life than others, depending where it lies on the skill/luck continuum (below).

Investing (unlike chess) is open to a large amount of outside influence, which can’t be controlled or predicted.

There is a simple test on the degree of luck/skill in an activity.

If you can’t lose on purpose, or if it’s really hard to, luck has a large effect on that activity.

If it’s easy to lose on purpose, skills is more important.

And remember, you cant have it both ways.

You can’t chastise your ‘bad luck’ when something goes against you, but then not accept some ‘good luck’ when things go your way.

Think golf – how many times does your opponent at the end of the round moan about the various moments of ‘bad luck’, but you never hear about the equal (or often greater) amount of ‘good luck’.

We should learn to accept both.

Facebook / Whatsapp…. desperate times or shrewd deal??

I first saw this story last week when reading the papers over breakfast one morning in Cape Town. I was a bit behind on the news…..

Whatsapp sold to Facebook for $19bn……$19bn!

A vast debate over breakfast followed between myself and the rest of the table, all with our own view on how ‘good a deal it was in the long term’, or how ‘its doomed for failure’.

What we did come to the conclusion to by the end of it was, actually, that none of us really have a clue.

Who are we to try to outguess Facebook, or to work out the real reasons and future value of the deal?

Now we are very much in the business here at Parkwalk of ‘game changing’ technology, and we welcome with open arms some of these valuations currently being found.

But, this is an extraordinary price tag.

What it does amplify are warnings that in the acquisitions arms race the tech giants may be inflating a social mdeia/app bubble.

It is a gamble that has unnerved many Facebook investors. The bullish insist he got a bargain.

This app might not have even existed if Zuckerberg had hired the two founders four years ago when they applied for jobs at FB (see the role of luck above….!)

Many experts see Zuckerberg operating from a position forced by a stagnation in new FB sign ups, particularly in young users. He paid the same for a firm whose only source of revenue is a 99 cent annual fee (which millions of early adopters, including me, avoided) – as the present value of companies like Sony, or Gap.

Some are saying this is the price FB has paid to take out a huge potential rival. But, it is a very expensive business to keep buying out the guys who could eat your lunch.

In my humble opinion (which was knocked back at breakfast!) it seems to me like simply a high stakes battle between FB and Google for the prize of users, across which streams of advertising can be delivered.

I believe the deal may have been centered more on the cost of FB not buying Whatsapp, rather than the price they paid. They could not risk the 450m monthly users falling into the hands of Google.

The question is when does it all become too much, or has it already?

Markets

and reversion to the mean….

One of my favourite investors to follow, Jeremy Grantham, is well known for his extensive work on bubbles in markets.

I don’t always buy into his views, but you can’t argue with his track record, over the long term.

Over the short term however, his bearish stance has come in for a bit of stick as stock markets have reached record highs.

But he is a long term thinker, and isn’t budging. He is undeterred by short term market movements.

I particularly enjoyed his response when asked what people would learn from the financial crisis.

‘In the short term a lot, in the medium term a little, in the long term nothing at all’

He is a believer that in the long term eventually we see things always revert to the mean.

One of his big calls currently is that we will see no returns in the stock market over the next 7 years. This is based on the idea that long term stock market valuations tend to revert to the mean, and currently valuations are well above the mean.

His chart below suggests that no matter what upside and downside surprises we get in the world, market valuations always seem to revert to their long term means.

He may be right or wrong, but that’s his view and he’s sticking to it.

And that’s what makes a market…

Other bits of interest….